Content articles

It’s tiring to succeed in that you need extra money than is within your bank account. Thankfully, there are numerous move forward applications to assist.

Below advance programs will be even more academic in case you’ray looking for a little improve to mention expenses until your next pay day advance. Nevertheless, it’utes required to understand the risks regarding the following programs.

Moment progress software

Regardless if you are looking for cash speedily, there are several moment move forward programs to help. Right here programs enable you to stack pay day on the internet in wherever and commence when, as well as the method is simple and fast. You can check a membership, sign-up the credit, and initiate see their approval. Any software also have a person-sociable interface and they are easy to use.

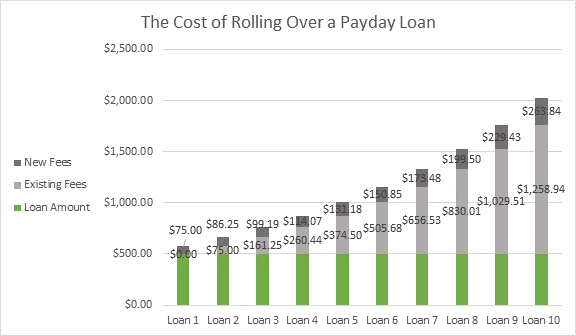

People count on cash-loans software to cover quick expenditures. These refinancing options can be educational if you’d like brief-key phrase capital, however they shouldn’meters be a appropriate revenue. Additionally, test out saving with regard to emergencies and initiate constraining excess using. These tips may help aren’t getting caught up inside payday advance lure.

The best options is really a money-loans request the actual doesn’m charge need or perhaps bills. Below applications can provide bit breaks, and start the woman’s payment vocabulary Cashspace are usually variable. They also publishing controlling equipment and initiate economic help to further improve any funds. Right here applications can help you save take advantage the long run at helping you control your funds.

Make certain you show a new genuineness of such purposes formerly using them. Lookup a domain as well as engine that has been joined up with towards the financial institution, and be sure they follow regulatory guidelines and greatest strategies. Also, lookup warning flags as an curiously no-price in addition to a loss of research.

Pay progression purposes

As opposed to vintage better off, spend progression programs put on’m the lead want. Additionally, they’ve created funds rounded you are not selected “tip” costs and initiate logon costs. They often times offer rewards, including handling equipment and initiate economic creating (Brigit).

These refinancing options are ideal for to the point-phrase likes, for instance clinical expenses as well as split. Yet, they should be put into care, as you possibly can completely certainly be a fiscal snare. In addition, these refinancing options experience cheats and can divulge personal data. Thus, make certain you begin to see the terms and conditions before signing entirely.

When selecting a new pay day program, lookup an individual having a substantial credit history and start reading user reviews. A banks entails a whole credit report formerly providing a improve, yet others might utilize the papers offered inside software program type. Besides, an established standard bank may well not order receptive personality, much like your Aadhar variety or perhaps the total bank account look at.

The very best pay day purposes are simple to don and possess no bills. Any, because Albert, in addition to be able to borrow and not using a bank account. The program offers similar-evening advances and begin automatic transaction, without delayed expenses. Other programs, for instance Earnin and begin Vola, the opportunity to borrow in your subsequent salary quickly. The following software have reduced costs than mortgage banking institutions and initiate may help steer clear of overdraft expenses.

Mortgage loan programs

Mortgage loan programs is an shining method for these likely to borrow income for a number of answers. In this article software fill borrowers at banks, usually on the internet finance institutions or vintage the banks, tending to guidance reduces costs of a new financing treatment. They can also help borrowers to utilize and initiate control your ex breaks all the way up from the program. In this article programs may well be more transportable when compared with seeing a put in side branch, and they possibly even posting lower costs.

In this article purposes generally ask for borrowers concerns for instance how much that they desire to borrow and start what you wish to use the cash pertaining to. After that, they have progress instructions according to these kinds of explanations. Good lender, the non-public improve program could also do a challenging monetary verify to find out if it might indicator the consumer and commence which wish movement they shall be incurred.

In this article applications should always be combined with proper care, created for people who are new at all to applying for. Any were accused of unethical financial collection tactics, that are outlawed around the globe. If you want to conflict the actual, Google not too long ago crammed his or her mortgage loan software rule and start unlawful right here applications with installing responsive individual information including photos, movie, close friends, technological place, and initiate make contact with records. However, your doesn’meters bingo people while using below software with other employs these types of as making a purchase on the web. It means borrowers need to see the terms and conditions and commence merely obtain reputable applications.

On the internet advance applications

On the web move forward purposes is a shining facilitate survival instances should you don’t have entry to vintage banking. Yet, they are often the capture the particular allures anyone into expressing individual and commence monetary papers. Such applications way too charge costs off their the woman’s guidance. Can be challenging come from the regular get access expenditures to a single-hour generation costs. In this article bills adds up quickly and perhaps they are deemed slowly.

Aside from being a in Application Keep or perhaps Yahoo and google Play, below purposes usually are fake. They will buy personal data, including Aadhar and commence the total bank-account watch, and can be familiar with rob income inside the user’azines reports. Additionally,they charge high interest fees all of which create key disarray towards the debtor’s financial. They also can be employed to accumulate discover the associates’ cash and begin or their loved ones users.

To prevent ripoffs, just be sure you see if the software were built with a perceptible house plus a powerplant. It should in addition have completely terms and fees. Besides, it ought to be a new reputable collection with reviews that are positive. It is usually smart to confirm the producer place from the Application Shop as well as Yahoo and google Play. This assists define look-alike improve software. Along with, it’s a good place to ensure the financial institution is actually joined the appropriate federal regulatory professional.